sales tax calculator reno nv

Cannabis or products sold to a patient cardholder are not subject to this 10 excise tax. The Nevada sales tax rate is currently.

Sales Taxes In The United States Wikiwand

A set of standard license plates costs 8.

. For tax rates in other cities see Nevada sales taxes by city and county. The minimum combined 2022 sales tax rate for Reno Nevada is. This is an increase of 18 of 1 percent on the sale of all tangible personal property that is taxable.

31 Campolina St Reno NV 89511 960000 MLS 220003407 This single-floor open concept plan features a spacious kitchen and great room at the hea. Effective January 1 2020 the Clark County sales and use tax rate increased to 8375. Depending on local municipalities the total tax rate can be as high as 8265.

The December 2020 total local sales tax rate was also 8265. Reno Nevada and Las Vegas Nevada. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Reno NV.

The 2011 Legislation Session pursuant to AB 504 reduced the interest rate to 075 or 0075 from 1 or 01 effective 712011. Nevada NV Sales Tax Rates by City A The state sales tax rate in Nevadais 6850. This means that depending on your location within Nevada the total tax you pay can be significantly higher than the 46 state sales tax.

Starting July 1 2017 cannabis will be taxed in the following way. 053 average effective rate. Nevada sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

2022 Cost of Living Calculator for Taxes. The County sales tax rate is. Nevada State Tax Quick Facts.

The base state sales tax rate in Nevada is 46. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services. 2022 Cost of Living Calculator for TaxesReno Nevada and Las Vegas Nevada.

For more accurate rates use the sales tax calculator. Nevada Internet Sales Tax Nolo New Rules on Collecting Sales Tax for Remote Sellers. 15 excise tax on the first wholesale sale calculated on the Fair Market Value.

Therefore a home which has a replacement value of 100000 will have an assessed value of 35000 100000 x 35 and the home owner will pay approximately 1281 in property taxes 35000 x 3660615. Find your Nevada combined state and local tax rate. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes.

The total overlapping tax rate subject to approval by the Nevada Tax Commission for the City of Reno is 3660615 per 100 of assessed valuation. Local tax rates in Nevada range from 0 to 3665 making the sales tax range in Nevada 46 to 8265. The 8265 sales tax rate in Reno consists of 46 Nevada state sales tax and 3665 Washoe County sales tax.

2022 Nevada state sales tax. Fees for a first-time Nevada title are 2825. Ad Your Business Can Automate Sales Tax and File Returns for Free in 24 States with Avalara.

With local taxes the total sales tax rate is between 6850 and 8375. You can print a 8265 sales tax table here. NV Sales Tax Rate.

Nevada largely earns money from its sales tax which can be one of the highest in the nation and varies from 685 to 8375. There is a 6 Safety Fee on motorcycle registrations that funds safety programs and training. There is no applicable city tax or special tax.

The current total local sales tax rate in Reno NV is 8265. Groceries and prescription drugs are exempt from the Nevada sales tax. Sales Tax Nevada Reno.

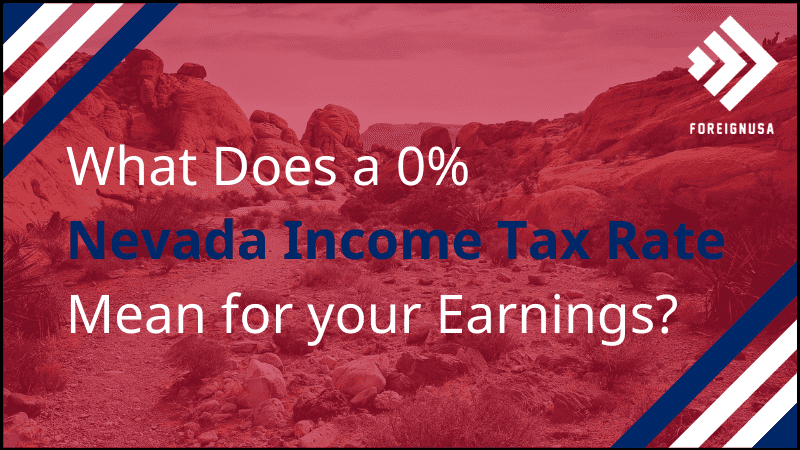

The Nevada state sales tax rate is 685 and the average NV sales tax after local surtaxes is 794. Low property taxes and the absence of any state or local income taxes in Nevada can make it a particularly affordable place to own a home. 10 retail excise tax on the sale price when sold by an adult-use cannabis retail store.

The DMV collects sales taxes on many out-of-state dealer sales. See pricing and listing details of Reno real estate for sale. The Reno sales tax rate is.

Nevada first adopted a general state sales tax in 1955 and since that time the rate has risen to. Sales Tax Calculator Sales Tax Table. 2300 cents per gallon.

Our Certified Software Makes It Easier to Manage Multi-State Tax Compliance. There are other factors which determine the final cost of registering a vehicle. 2 beds 25 baths 1791 sq.

This is the total of state county and city sales tax rates. View 1547 homes for sale in Reno NV at a median listing price of 319900. Nevada has a 46 statewide sales tax rate but also has 34 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3357 on top of the state tax.

Exact tax amount may vary for different items. Other local-level tax rates in the state of Nevada are quite complex compared against local-level tax rates in other states. The Nevada NV state sales tax rate is currently 46.

Nevada has recent rate changesSat Feb 01 2020.

Nevada Vs California Taxes Explained Retirebetternow Com

Nevada Income Tax Calculator Smartasset

Sales Tax By State Should You Charge Sales Tax On Digital Products Taxjar

Nevada Income Tax Calculator Smartasset

Nevada Income Tax Calculator Smartasset

Nevada Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikiwand

Origin Based And Destination Based Sales Tax Rate Taxjar

Defining Sales Tax Sellers Use Tax And Consumer Use Tax Vertex Inc

The Nevada Income Tax Rate Is 0 This Does Not Mean You Will Not Be Taxed On Your Earnings

Sales Taxes In The United States Wikiwand

Oklahoma Sales Tax Calculator Reverse Sales Dremployee

Sales Tax In Las Vegas Nv Sema Data Co Op

Sales Taxes In The United States Wikiwand

Tax Burdens In All 50 States Thestreet

Sales Taxes In The United States Wikiwand

The Reno County Kansas Local Sales Tax Rate Is A Minimum Of 7 5