capital gains tax changes 2020

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. The IRS typically allows you to exclude up to.

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

It isnt available for the 2022 tax year it was available.

. Before this date CGT was reported. If you bought an asset on February 1 2020 your holding period started on February 2. For 2020-21 the annual exempt amount is 12300 but the OTS.

By Esmée Hardwick-Slack. You can find out more about. Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed.

SEE MORE Tax Changes and Key Amounts for the 2021 Tax Year However which one of those capital gains rates 0 15 or 20 applies to you depends on your taxable. As you may well be aware there was a significant change on April 6 2020 to the way capital gains tax CGT is reported and paid to HMRC. File your taxes stress-free online with TaxAct.

If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. In the 2018 Budget former Chancellor Phillip Hammond announced a couple of changes to the capital gains tax CGT regime and reliefs available to. The main changes that were made to Capital Gains Tax were regarding the deadlines for paying it after selling a residential property in the UK.

Long-term capital gains taxes are assessed if. The UK residential property sector has already seen several changes to the tax regime in recent years but more are coming. Capital gains tax rates on most assets held for a year or less.

Taxpayers who dont itemize deductions can claim the standard deduction an amount predetermined by the IRS that. For more on long-term capital gains tax rates. Find out all of the proposed changes to the capital gains tax system and how they could affect your tax bill.

Thirty-five states have major tax changes taking effect on January 1 2020. Weve got all the 2021 and 2022 capital gains tax rates in one place. Since 6th April 2020 if.

From 2020-21 landlords will only be able to offset 20 of their mortgage interest payments when filing their tax returns. Americans are facing a long list of tax changes for the 2022 tax year. 250000 of capital gains on real estate if youre single.

Filing your taxes just became easier. The rates do not stop there. Capital Gains Tax changes.

From 6 April 2020 the changes below will apply to. Mortgage interest tax relief changes. If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately.

The standard deduction increased for inflation. The main changes that were made to Capital Gains Tax were regarding the deadlines for paying it after selling a residential property in the UK. Arkansas Tennessee and Massachusetts will each see reductions in their individual income.

The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 - understand the changes and what you need to do. Rates for long-term capital gains are based on set income thresholds that are adjusted annually for inflation. The Lowdown on Capital Gains Tax Rates for 2020 and Beyond.

Ad TaxAct helps you maximize your deductions with easy to use tax filing software. Additionally a section 1250 gain the portion of a gain. 500000 of capital gains on real estate if youre married and filing jointly.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

What You Need To Know About Capital Gains Tax

What You Need To Know About Capital Gains Tax

How High Are Capital Gains Taxes In Your State Tax Foundation

Capital Gains Tax Calculator For Relative Value Investing

How Do Taxes Affect Income Inequality Tax Policy Center

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How Do State And Local Individual Income Taxes Work Tax Policy Center

Can Capital Gains Push Me Into A Higher Tax Bracket

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

Capital Gains Tax Calculator For Relative Value Investing

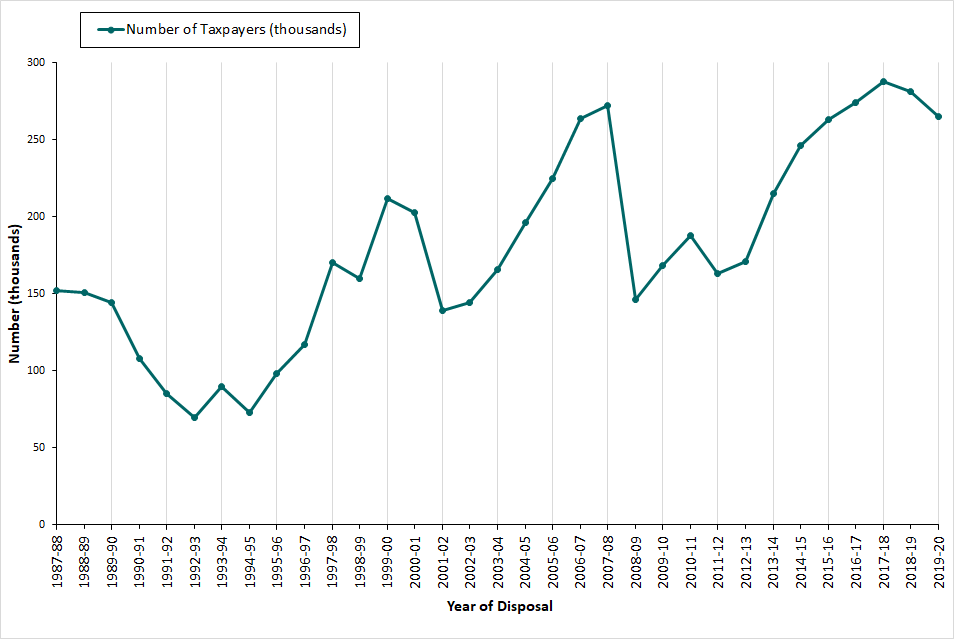

Capital Gains Tax Commentary Gov Uk

What You Need To Know About Capital Gains Tax

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)